Barefoot Investor for Freelancers | 12-Month Financial Freedom Plan

Based on $10,000 Monthly Average Income

CURRENT FINANCIAL SNAPSHOT

Monthly Income: $10,000 (average from freelance work)

Essential Monthly Expenses: $3,500

6-Month Emergency Fund Target: $21,000

Example, Current Debt: $15,000 (business startup loan at 8% interest)

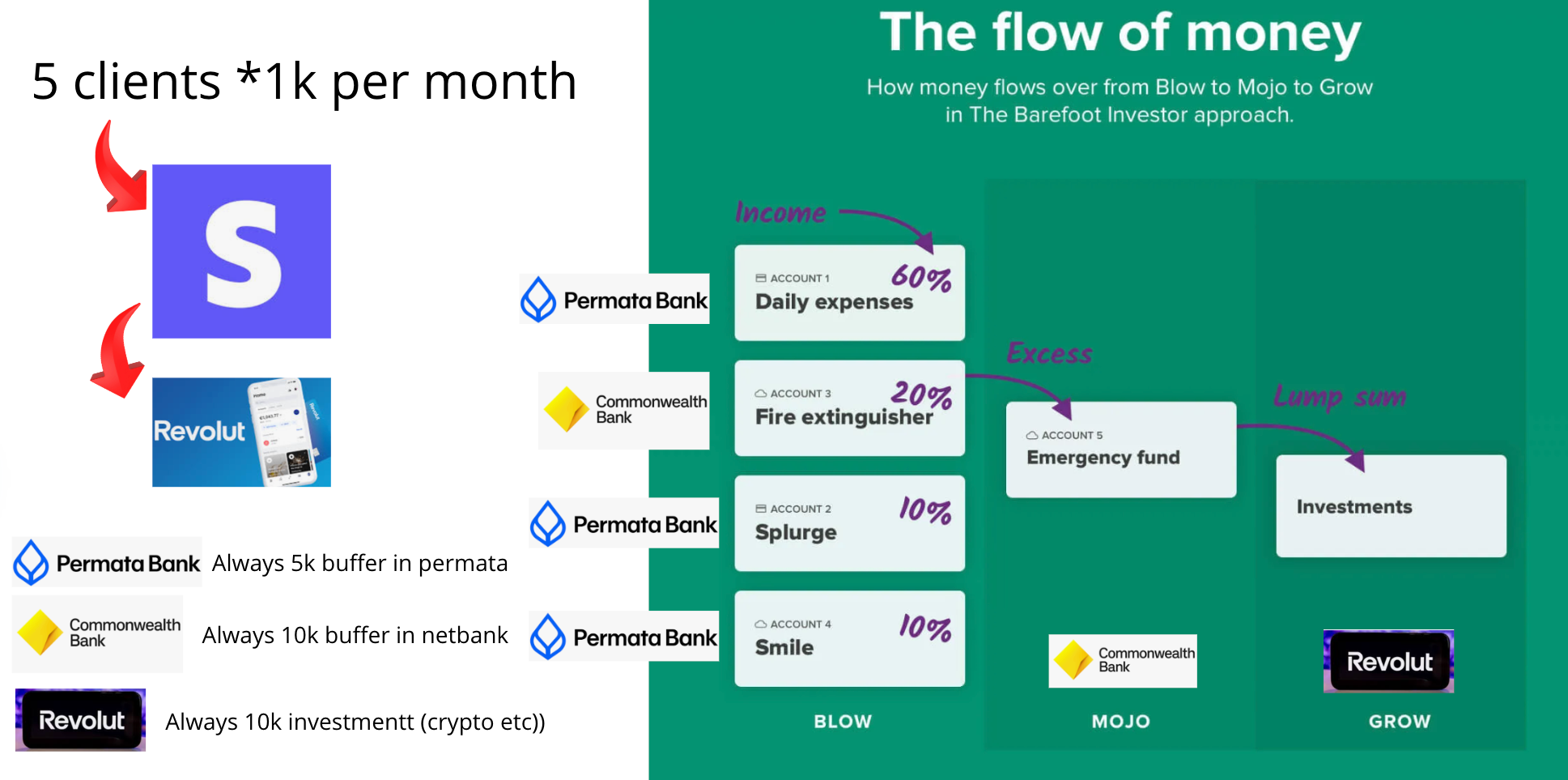

ACCOUNT STRUCTURE

INCOME COLLECTION

- Bank: Revolut / Wise

- Purpose: Central collection point for all client payments

- Action: Set up automatic transfers on 1st of each month to all buckets

BLOW BUCKET (50% - $5,000)

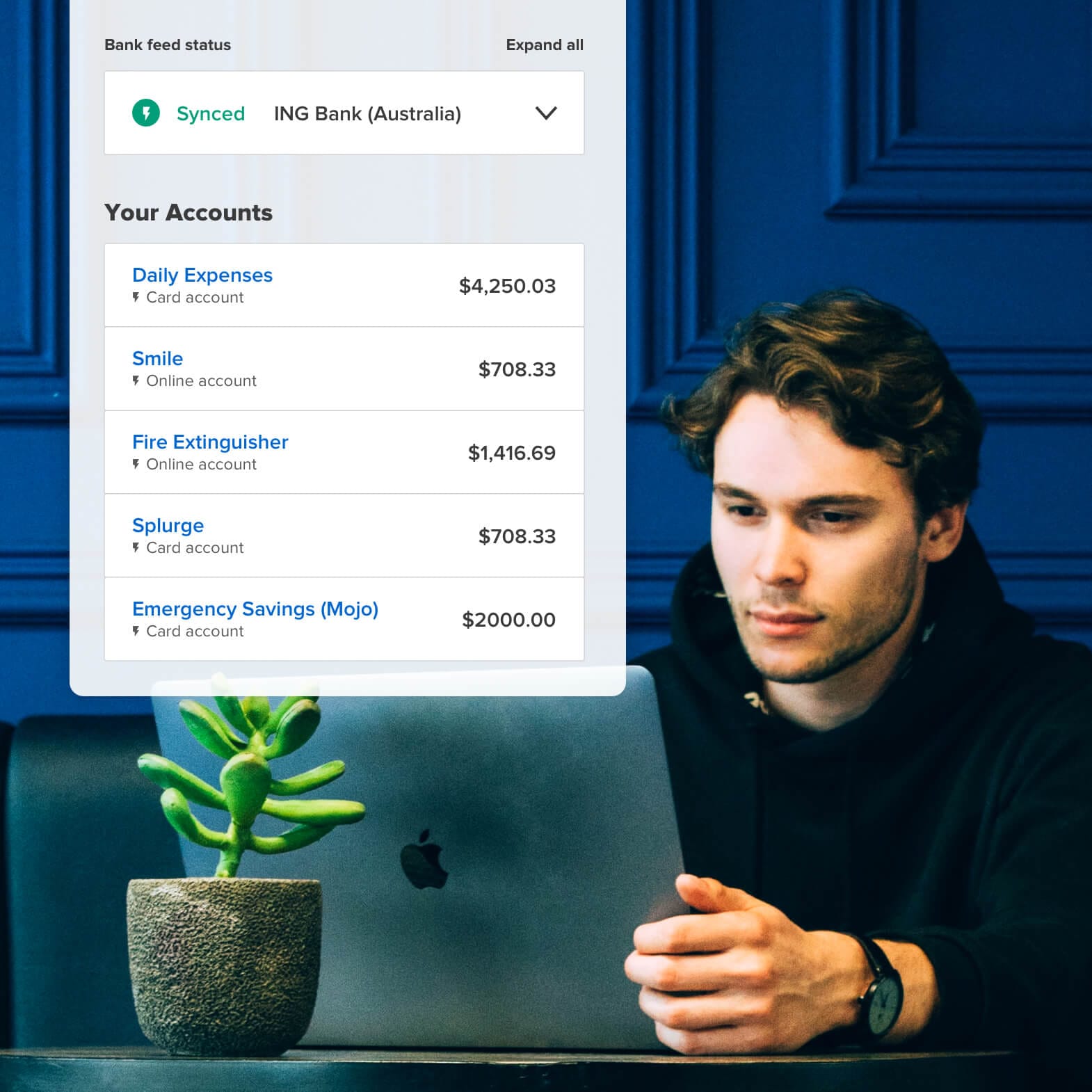

1. Daily Expenses (30% - $3,000)

- Bank: Permata Bank

- Account Type: Transaction account with debit card

- Purpose: Rent, utilities, groceries, subscriptions, basic transportation

- Action: Set up automatic payment for all regular bills

2. Splurge (10% - $1,000)

- Bank: Permata Bank

- Account Type: Separate transaction account with dedicated debit card

- Purpose: Entertainment, dining out, shopping, no-guilt spending

- Action: Use only for discretionary spending, no bill payments

3. Fire Extinguisher (10% - $1,000)

- Bank: Commonwealth Bank

- Account Type: Online savings account

- Purpose: Initially for debt repayment, then emergency fund building

- Action: Set up automatic payment to business loan until paid off

4. Smile (10% - $1,000)

- Bank: Commonwealth Bank

- Account Type: Online savings account

- Purpose: Professional development, business equipment, travel

- Action: Save for specific goals: $5,000 for new equipment, $7,000 for industry conference

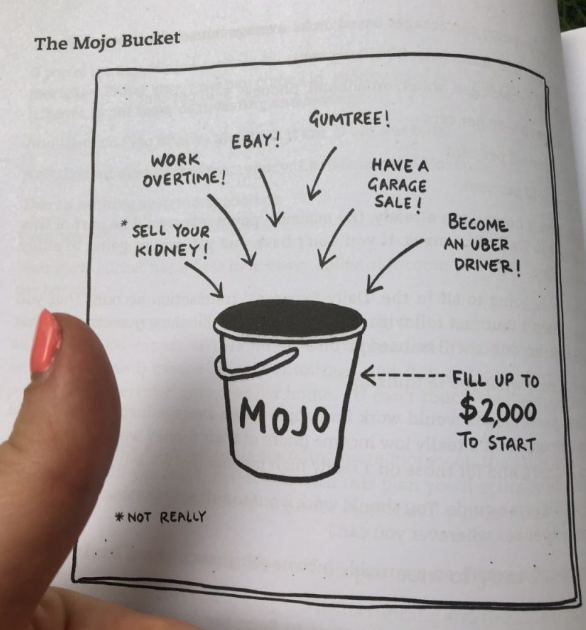

MOJO BUCKET (20% - $2,000)

5. Emergency Fund (20% - $2,000)

- Bank: Commonwealth Bank (separate from daily banks)

- Account Type: High-yield savings account

- Purpose: Financial security during inconsistent income periods

- Initial Target: $5,000 by month 3

- Full Target: $21,000 (6 months of essential expenses)

- Action: Direct transfers plus Fire Extinguisher overflow once debt is paid

GROW BUCKET (30% - $3,000)

6. Long-Term Savings (10% - $1,000)

- Bank: Commonwealth Bank

- Account Type: Term deposit or high-yield savings

- Purpose: Business expansion fund, property down payment

- Target: $30,000 by end of 12 months

- Action: Automatic monthly transfers

7. Investments (20% - $2,000)

- Institution: Interactive Brokers

- Account Types:

- Retirement account: $1,000/month

- Brokerage account: $1,000/month

- Strategy: 80% index funds, 20% individual stocks

- Action: Set up automatic investments on 5th of each month

12-MONTH ACTION PLAN

MONTH 1: FOUNDATION SETUP

- ✓ Open all required accounts

- ✓ Set up automatic transfers

- ✓ Create business income tracking system

- ✓ Establish initial $2,000 emergency fund

- ✓ Audit and optimize essential expenses

MONTH 2-3: DEBT FOCUS

- ✓ Make minimum payments on business loan

- ✓ Direct entire Fire Extinguisher to additional loan payments

- ✓ Build emergency fund to $5,000

- ✓ Begin retirement account contributions

- ✓ Create client pipeline management system

MONTH 4-6: EMERGENCY FUND BUILDING

- ✓ Continue business loan payments

- ✓ Increase emergency fund to $10,000

- ✓ Create quarterly tax payment system

- ✓ Review and optimize business expenses

- ✓ Invest in key professional development course

MONTH 7-9: STABILITY CREATION

- ✓ Pay off business loan completely

- ✓ Redirect Fire Extinguisher to emergency fund

- ✓ Complete $21,000 emergency fund

- ✓ Begin redirecting MOJO overflow to long-term savings

- ✓ Purchase upgraded business equipment from Smile fund

MONTH 10-12: GROWTH ACCELERATION

- ✓ Max out retirement contributions

- ✓ Begin additional investment in brokerage account

- ✓ Establish business emergency fund separate from personal

- ✓ Attend industry conference using Smile fund

- ✓ Set up passive income stream experiment

FINANCIAL MILESTONES

| Month | Key Milestone | Amount |

|---|---|---|

| 3 | Initial Emergency Fund | $5,000 |

| 6 | Business Loan 50% Paid | $7,500 |

| 9 | Business Loan Eliminated | $15,000 |

| 10 | Full Emergency Fund | $21,000 |

| 12 | Business Expansion Fund | $30,000 |

| 12 | Retirement + Investment Balance | $24,000 |

FREELANCE-SPECIFIC STRATEGIES

CLIENT PIPELINE MANAGEMENT

- Dedicate 5 hours weekly to marketing regardless of workload

- Maintain minimum 3 active clients at all times

- Develop 2 additional income streams by month 6

- Create 1 passive product by month 10

TAX MANAGEMENT

- Set aside 25% of all income for taxes

- Make quarterly estimated tax payments

- Track all business expenses meticulously

- Consult with accountant quarterly

INCOME SMOOTHING

- Maintain 2-month buffer in business account

- During high-income months, increase savings rate

- During low-income months, maintain essential allocations

- Target 3 anchor clients with retainer arrangements

IDEAL LIFESTYLE DESIGN

At the end of 12 months, your financial foundation will enable:

- Financial security with full emergency fund

- Debt freedom with business loan eliminated

- Work flexibility with stable client base

- Growth opportunity with business expansion fund

- Future security with retirement planning begun

Your freelance business will be structured to provide both income and freedom, with clear boundaries between work and personal time. The emergency fund will allow you to be selective about clients and projects, focusing on work that aligns with your values and long-term goals.

MONTHLY REVIEW CHECKLIST

☐ Review income vs. projections

☐ Confirm all bucket transfers completed

☐ Track emergency fund progress

☐ Evaluate debt paydown progress

☐ Review client pipeline health

☐ Assess business expense optimization

☐ Check investment performance

QUARTERLY DEEP DIVE

☐ Tax planning and estimated payments

☐ Professional development assessment

☐ Business growth strategy review

☐ Investment portfolio rebalancing

☐ System optimization opportunities

☐ Update financial freedom timeline

This 12-month plan provides both structure and flexibility, acknowledging the unique challenges of freelance income while creating the stability needed for long-term financial freedom.