Financial Freedom for Partners | The Barefoot Couple System

Combined Vision for Shared Goals & Individual Freedom

This system creates financial harmony for couples by combining resources for shared goals while preserving individual autonomy. It acknowledges that true partnership means rowing in the same direction toward common dreams while maintaining personal financial identity.

Without Children - Example, $10,000 Combined Monthly Income

CURRENT FINANCIAL SNAPSHOT

Combined Monthly Income: $10,000

Individual Contributions: Partner 1: $6,000 / Partner 2: $4,000

Essential Monthly Expenses: $5,000

6-Month Emergency Fund Target: $30,000

Current Debt: $20,000 (car loan at 5%, credit cards at 18%)

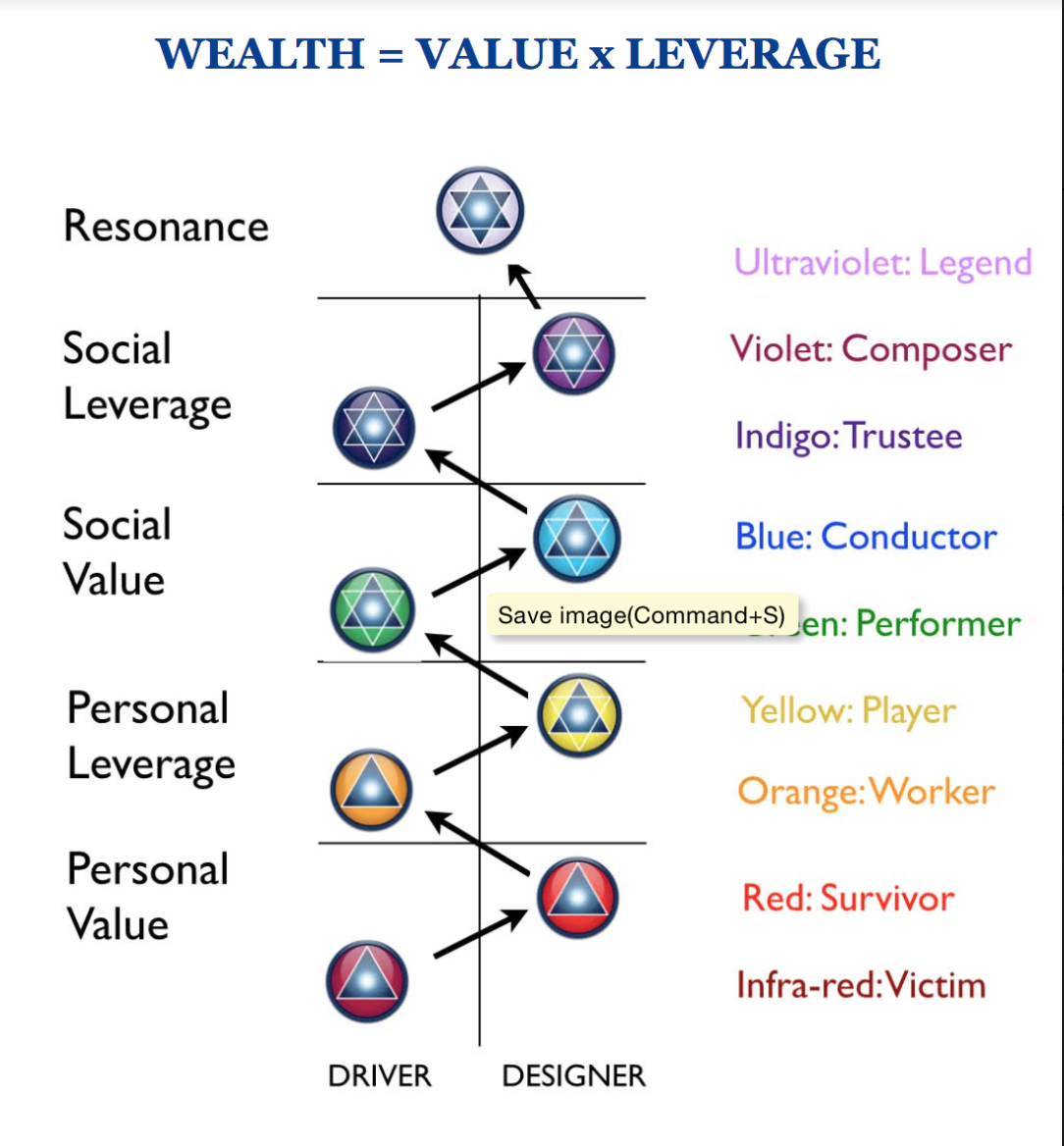

Two people in the green, growing together 1+1 = 11 mentality, Yellow = Self, Green and above is combine

ACCOUNT STRUCTURE

INDIVIDUAL ACCOUNTS (Pay % to partner account)

Here are a few alternative scenarios that could work just as well:

Scenario 1: Uneven Contributions (8k/2k)

- Business 1 (Partner 1): Contributes $8,000/month

- Business 2 (Partner 2): Contributes $2,000/month

- Business 3 (Joint): $0 (perhaps in development phase)

- Total: Still $10,000 to family account

Scenario 2: Single Income (10k/0)

- Business 1 (Partner 1): Contributes $10,000/month

- Business 2 (Partner 2): $0 (perhaps focusing on family care, education, or business startup)

- Business 3 (Joint): $0 (perhaps in planning phase)

- Total: Still $10,000 to family account

Key Principle: Equal Personal Allowances

The critical aspect that makes this work regardless of contribution amount is that both partners still receive equal personal allowances from the combined family account.

Even if Partner 1 contributes $10,000 and Partner 2 contributes $0, they would each still receive their $1,500 personal allowance. This maintains financial sovereignty for both partners regardless of who generates the income.

This approach acknowledges that:

- Income can fluctuate between partners over time

- One partner may support the other through various life phases

- Non-income-generating work (childcare, home management, education) has value

- Financial partnership is about shared goals, not just individual contribution

The system is designed to flex with your unique partnership dynamics while still providing financial security and autonomy for both individuals.

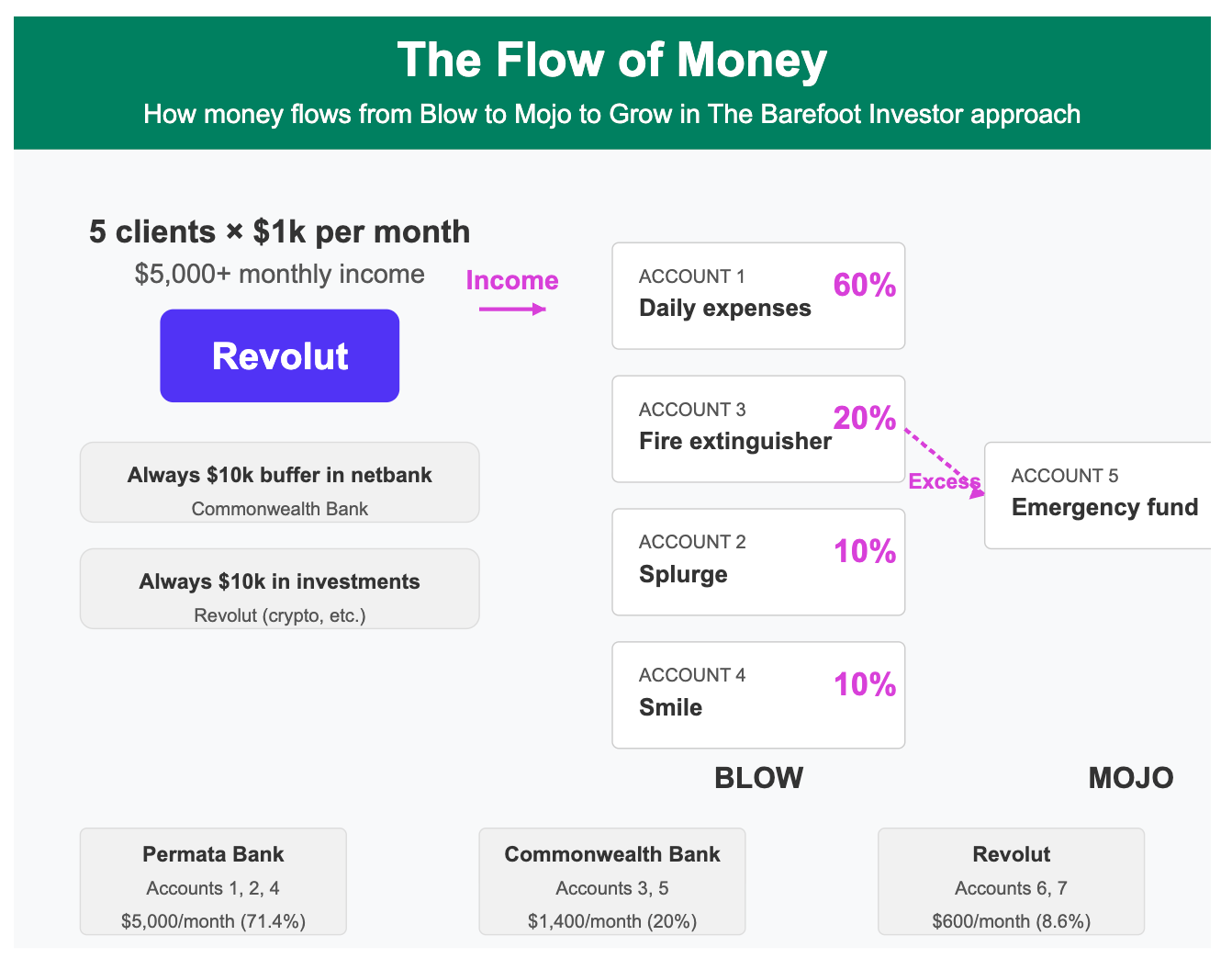

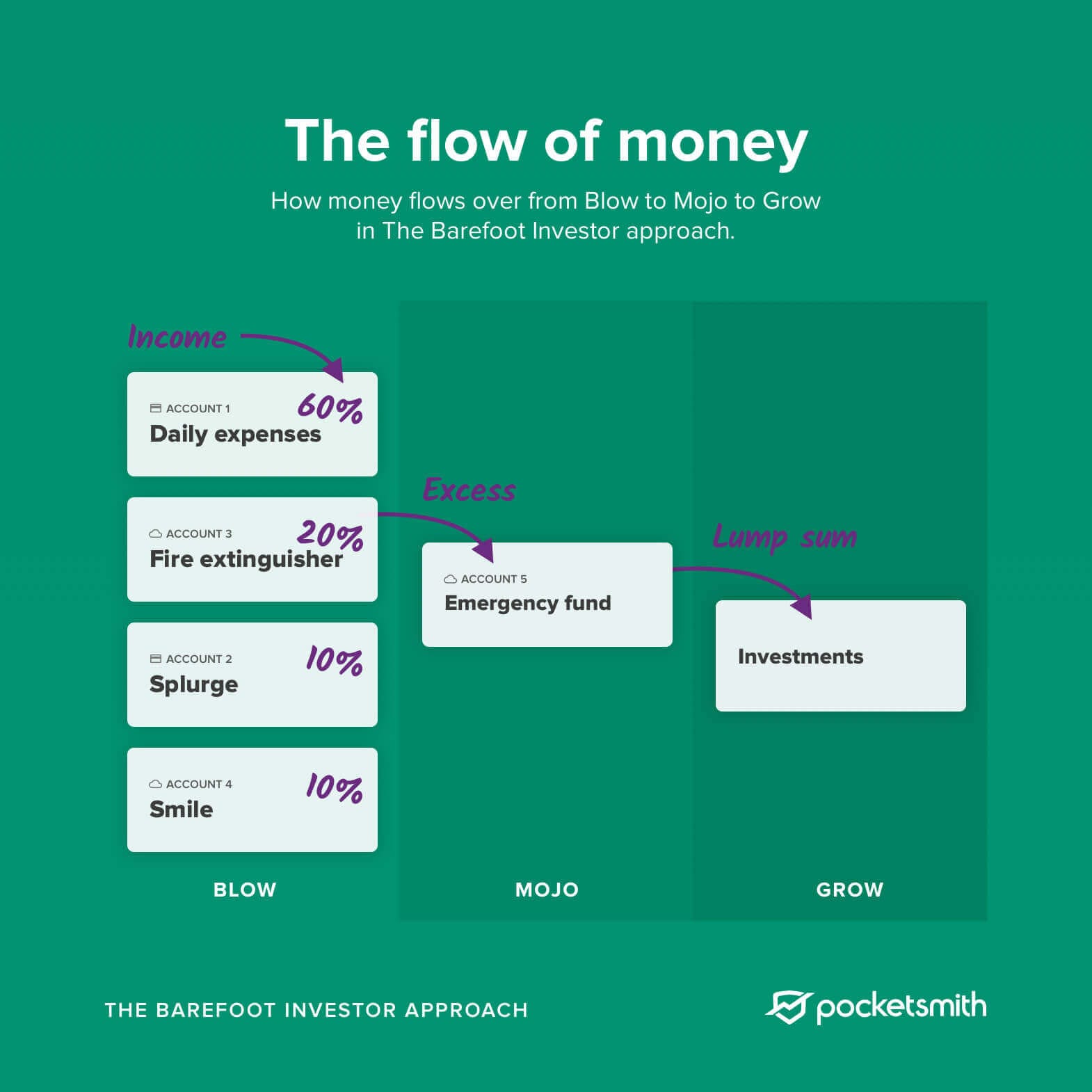

STEP 1: COMBINED BLOW ACCOUNT

(60% of 100% Income )

Set Up a COMBINED PARTNER ACCOUNT

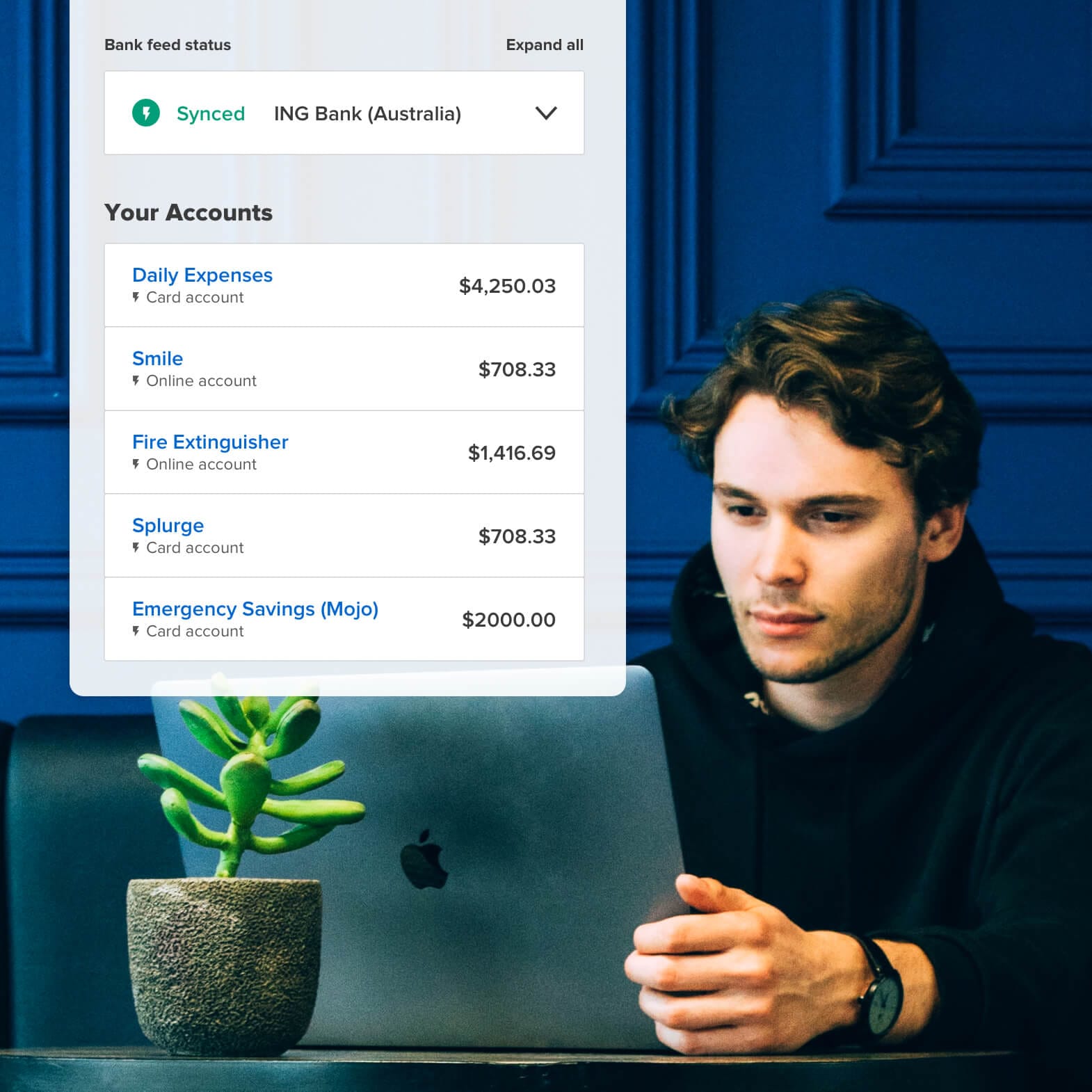

- Bank: Revolut / Wise

- Purpose: Receives all income before distribution

- Action: Set up automatic transfers on 1st of each month

- Seperate to individual accounts (new account)

Combined Account Expenses

- Housing: Rent/mortgage, utilities, maintenance

- Food: Groceries, basic household supplies

- Transportation: Vehicle expenses, fuel, maintenance

- Insurance: Health, home, life, auto

- Shared Subscriptions: Entertainment, services

- Debt Elimination: Combined debt reduction plan

- Initial Allocation: $6,000/month (based on $10,000 income)

PARTNERS COMBINED LIVING/LIFESTYLE EXPENSES (60% - $6,000)

Combined Daily Expenses Account (45% - $4,500)

- Bank: Permata Bank

- Account Type: Joint transaction account

- Purpose: Rent/mortgage, utilities, groceries, shared subscriptions, insurance

- Action: Set up automatic payments for all shared bills

Combined Adventures (15% - $1,500)

- Bank: Permata Bank

- Account Type: Joint savings account

- Purpose: Travel fund, entertainment, date nights, shared experiences

- Action: Save for specific goals: $6,000 vacation, $3,000 home upgrades

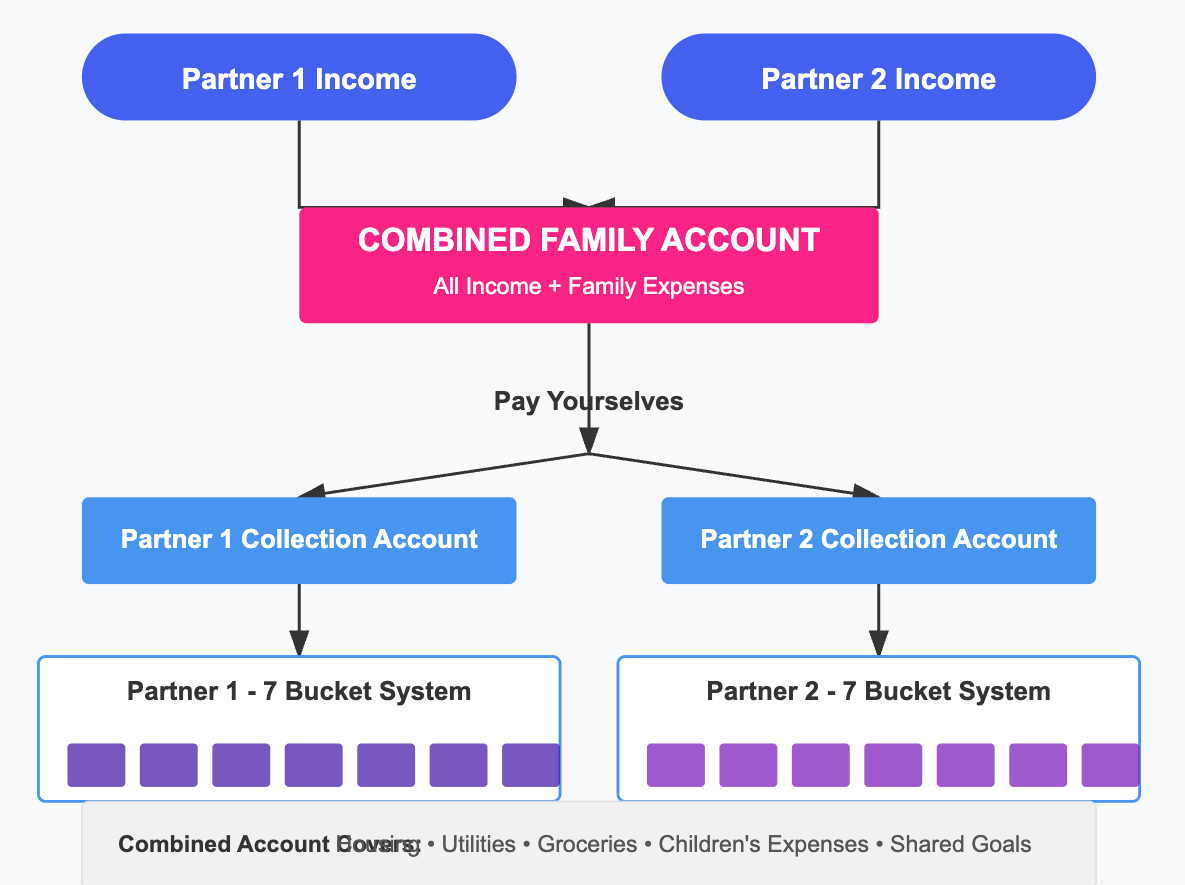

PERSONAL ALLOWANCES (40% - $4,000)

*Each partner can manage their own personal cash flow, use their money with sovereignty and autonomy. But, they both contribute to the combined account in what ever arrangement works best for their situation and agreements.

Partner 1 Personal Account (20% - $2,000)

- Bank: Individual choice

- Purpose: Complete financial autonomy

- Action: Implement individual 7-bucket system

Partner 2 Personal Account (20% - $2,000)

- Bank: Individual choice

- Purpose: Complete financial autonomy

- Action: Implement individual 7-bucket system

STEP 2: COMBINED VISION BUCKETS (20%)

MOJO Bucket (Combined Emergency Fund)

- Bank: Commonwealth Bank (separate from daily banking)

- Account Type: High-yield savings account

- Initial Target: $5,000 by Month 3

- Full Target: $30,000 (6 months of expenses)

- Monthly Contribution: $1,000 (10% of income)

- Purpose: Shared financial security

- Milestone Timeline:

- Month 3: $5,000

- Month 6: $12,000

- Month 9: $21,000

- Month 12: $30,000

GROW Bucket (Combined Long-Term Goals)

- Bank: Commonwealth Bank and investment platforms

- Account Type: Joint investment accounts

- Contribution: $1,000/month (10% of income)

- House Down Payment Fund:

- Target: $60,000 over 36 months

- Monthly Allocation: $600 (6%)

- Account Type: High-yield savings

- Purpose: Future home purchase

- Joint Investment Portfolio:

- Monthly Allocation: $400 (4%)

- Account Type: Brokerage account

- Purpose: Long-term wealth building

- Strategy: Agreed-upon risk profile and investment choices

STEP 3: PAY YOURSELVES

Personal Allowance Transfers

- Total Personal Allocations: $2,000/month (20% of income)

- Each Partner Receives: $1,000 (10% each)

- Frequency: Bi-weekly or monthly on fixed dates

- Transfer Automation:

- Setup: Automatic transfers on the same day each month

- Destination: Individual personal collection accounts

- Timing: After shared expenses and combined vision buckets

STEP 4: INDIVIDUAL BUCKETS

Each partner maintains individual bucket systems with their personal allowance:

Partner 1's Personal System

- Collection Account: Receives $1,000 personal allowance

- Account Type: Individual account (Revolut, etc.)

- Purpose: Financial autonomy and personal goals

Partner 2's Personal System

- Collection Account: Receives $1,000 personal allowance

- Account Type: Individual account (Revolut, etc.)

- Purpose: Financial autonomy and personal goals

Individual Bucket Breakdown

Each partner allocates their $1,000 allowance:

- Daily Expenses (20%): $200

- Personal lunches, transportation

- Individual subscriptions, personal care

- Splurge (40%): $400

- Individual entertainment, hobbies

- No-questions-asked discretionary spending

- Personal luxuries

- Smile (40%): $400

- Individual adventures and experiences

- Personal development, education, courses

- Gifts for partner or others

STEP 5: DEBT ELIMINATION PLAN

*Each partner is repsonsible for their own debt prior to the connection, but they can work together to free each other from past debt. Again, make what ever arrangements and agreements specific to your partnership and goals. The end goal is that both feel free and abundant in the connection, to grow together.

Combined Debt Strategy

- Monthly Allocation: $1,000 from Combined Account

- Focus Order: Highest interest debt first (debt avalanche)

- Example Timeline:

- Credit Cards ($8,000 at 18%): Paid by Month 8

- Car Loan ($12,000 at 5%): Paid by Month 12

- After Debt Freedom: Redirect to house down payment fund

Implementation Approach

- Make minimum payments on all debts

- Put remaining debt allocation toward highest interest debt

- Celebrate each debt milestone together

- Once all debt is eliminated, accelerate housing fund

STEP 6: Perhaps, A HOUSE PURCHASE PLAN?

Down Payment Building

- Target: $60,000 (20% down on $300,000 home)

- Base Monthly Contribution: $600

- Additional Sources:

- Debt payment redirection after Month 12: +$1,000/month

- Periodic windfalls (tax returns, bonuses): Variable

- MOJO overflow once emergency fund complete: Variable

- Estimated Timeline: 24-36 months

Home Purchase Preparation

- Month 1-6: Research desired neighborhoods

- Month 7-12: Check and improve credit scores

- Month 13-18: Meet with mortgage brokers

- Month 19-24: Get pre-approved for mortgage

- Month 25+: Begin house hunting when down payment nears target

STEP 7: COMMUNICATION FRAMEWORK

*Money is energy, don't make it taboo. 95% of relationships have conlfict over money, but its never to do with the money, but each persons ability to feel safe in the connection, appreciated for the work they do and the polarities that allow real love to flourish. Noting, that in tough times, 2 people may have to double down and work together to get out of it too. It's never you vs your partner, but you and your partner vs the challenge finding a solution together. Life is unpredictable. It's easier together. Each of you has support and family beyond the connection that can be leaned on in times of need, for the benefit of the whole./

MONEY DATE SYSTEM (make it fun!)

- Weekly Check-in: 15-minute review of cash flow and upcoming expenses

- Monthly Deep Dive: 60-minute session reviewing:

- Progress toward shared goals

- Debt elimination status

- Emergency fund growth

- House fund progress

- Relationship financial satisfaction

- Quarterly Vision Session: 2-hour meeting to:

- Review and adjust investment strategy

- Update house purchase timeline

- Realign on financial priorities

- Celebrate progress and wins

Decision-Making Framework

- Individual Freedom: Complete autonomy over personal allowances

- Joint Decisions: Required for:

- Changes to shared expense allocations

- Investment strategy adjustments

- Major purchase timing

- Debt payoff approach

MONEY DATE STRUCTURE (EXAMPLE)

- Schedule: First Sunday of each month, 10 AM

- Duration: 1 hour followed by brunch

- Agenda:

- Review previous month spending

- Track progress toward goals

- Discuss upcoming large expenses

- Celebrate financial wins

- Address any concerns

COMMUNICATION FRAMEWORK

- "Hard" numbers discussion limited to money dates

- "Purchase consultation threshold": Discuss any individual purchase over $300

- Equal voice regardless of income contribution

- Decisions by consensus, not compromise

INDIVIDUAL FINANCIAL SOVEREIGNTY

- Each partner's personal allowance is theirs to manage

- No questions asked about personal spending

- Separate credit histories maintained

- Individual retirement accounts

MONTHLY REVIEW CHECKLIST

☐ Review combined expenses vs. budget

☐ Confirm all transfers completed

☐ Track emergency fund progress

☐ Evaluate debt paydown progress

☐ Update shared goals timeline

☐ Check investment performance

☐ Celebrate progress and wins

QUARTERLY DEEP DIVE

☐ Net worth calculation

☐ Insurance and estate plan review

☐ Investment strategy alignment

☐ Financial independence progress

☐ Long-term goal adjustment

☐ System optimization opportunities

FINANCIAL SECURITY ROADMAP

Phase 1: Foundation (Months 1-3)

- [x] Open all accounts

- [x] Set up automatic transfers

- [x] Establish initial $5,000 emergency fund

- [x] Begin debt elimination plan

- [x] Create house purchase research plan

Phase 2: Security Building (Months 4-6)

- [x] Continue debt payoff momentum

- [x] Grow emergency fund to $12,000

- [x] Begin investment contributions

- [x] Implement regular money date system

- [x] Improve credit scores if needed

Phase 3: Debt Freedom (Months 7-12)

- [x] Eliminate all consumer debt

- [x] Complete full emergency fund ($30,000)

- [x] Accelerate house down payment fund

- [x] Optimize tax strategy as couple

- [x] Review and update wills/estate plans

Phase 4: Wealth Building (Months 13-24)

- [x] Focus on house down payment fund

- [x] Maximize investment contributions

- [x] Develop detailed house purchase plan

- [x] Begin mortgage pre-approval process

- [x] Research neighborhoods and home options

BENEFITS OF THIS UNIFIED SYSTEM

Shared Vision Benefits

- Common Direction: Both partners working toward shared dreams

- Accelerated Progress: Combined resources reach goals faster

- Relationship Alignment: Financial partnership strengthens relationship

- Enhanced Security: Robust emergency fund protects both partners

- Property Ladder Entry: Systematic approach to home ownership

Individual Freedom Benefits

- Personal Autonomy: Each partner maintains financial independence

- No Money Fights: Clear boundaries for discretionary spending

- Reduced Money Stress: System prevents financial disagreements

- Equitable Structure: Equal personal allowances regardless of income differences

- Individual Expression: Freedom to pursue personal interests

ADJUSTING THE SYSTEM

This system can evolve as your situation changes:

Income Changes

- If income increases: Maintain same percentage allocations

- If income decreases: Prioritize emergency fund and essential expenses

Life Changes

- Children: Adjust to include dedicated children's expenses

- Career Change: Temporarily increase emergency fund contribution

- Relocation: Adjust housing fund timeline as needed

EXAMPLE a 12-MONTH ACTION PLAN

Common VISION: IDEAL LIFESTYLE DESIGN

At the end of 12 months, your financial foundation will enable:

- Complete debt freedom with all consumer debt eliminated

- Financial security with robust emergency fund

- Relationship harmony with clear money boundaries

- Financial independence progress with investment strategy

- Life enjoyment with funded adventures account

Your relationship will benefit from both financial teamwork and individual autonomy. Money conversations will shift from stressful to strategic, focusing on building your ideal future together while respecting individual financial identities.

MONTH 1: FOUNDATION SETUP

- ✓ Open joint accounts and emergency fund

- ✓ Set up automatic transfers for all buckets

- ✓ Create detailed debt payoff plan

- ✓ Establish initial $2,000 in combined emergency fund

- ✓ Schedule monthly money date (1st Sunday of each month)

MONTH 2-3: SECURITY BUILDING

- ✓ Build combined emergency fund to $5,000

- ✓ Begin aggressive credit card paydown

- ✓ Start individual emergency funds

- ✓ Review and optimize insurance coverage

- ✓ Create system for tracking shared vs. individual expenses

MONTH 4-6: DEBT ATTACK

- ✓ Continue aggressive credit card paydown

- ✓ Build combined emergency fund to $10,000

- ✓ Complete individual emergency funds ($5,000 each)

- ✓ Begin retirement account optimization

- ✓ Create estate planning documents (wills, powers of attorney)

MONTH 7-9: MOMENTUM BUILDING

- ✓ Pay off credit cards completely

- ✓ Redirect credit card payments to car loan

- ✓ Increase emergency fund to $20,000

- ✓ Begin saving for major vacation

- ✓ Review investment strategies and align approaches

MONTH 10-12: FREEDOM CREATION

- ✓ Pay off car loan completely

- ✓ Complete full emergency fund ($30,000)

- ✓ Implement investment strategy for surplus

- ✓ Plan celebration vacation from Adventures fund

- ✓ Develop long-term financial independence plan

DON't FORGET TO CELEBRATE MILESTONES!

Create specific celebrations for key financial achievements:

- Reaching emergency fund targets

- Becoming debt-free

- Saving each $10,000 for house down payment

- Annual net worth increases

This combined vision system creates the perfect balance - working together toward shared dreams while maintaining the individual freedom that keeps your relationship thriving.

| Month | Key Milestone | Amount |

|---|---|---|

| 3 | Initial Emergency Fund | $5,000 |

| 6 | Individual Emergency Funds | $5,000 each |

| 8 | Credit Cards Eliminated | $8,000 |

| 9 | Adventure Fund Goal | $6,000 |

| 12 | Car Loan Eliminated | $12,000 |

| 12 | Full Emergency Fund | $30,000 |