The 7-Bucket System: Your 12-Month Path to Financial Freedom | The Barefoot Investor Meets Maslow

Build Your Personal Money Flow System

This step-by-step template will help you create a personalized financial system that provides security, freedom, and peace of mind. By following this framework, you'll set up a money flow that works for your unique situation and goals.

"Money is simply energy, where Abundance = Value x Leverage"

🪄 Magic ChatGPT Prompt: Personal Finance System for Lifestyle Entrepreneurs

Copy & paste this into ChatGPT to build your 12-month financial flow plan:

"Act as a world-class financial strategist for lifestyle entrepreneurs. I will paste my personal financial situation below—including income, expenses, debts, goals, and any relevant notes. Help me build a 12-month financial freedom plan using the 'Money Flow System' framework. I want a plan that helps me live debt-free, meet all basic needs with ease, have surplus for joy and lifestyle upgrades, and create overflow to self-fund my long-term dreams and dharma projects.

Break it into these phases:

- Essentials Setup (Clarity & Allocation)

- Ask clarifying questions to calculate my monthly income, essential expenses, savings targets, and ideal percentages across the BLOW, FIRE EXTINGUISHER, SMILE, and MOJO buckets.

- Fill in any missing info with best-practice examples based on lifestyle entrepreneur averages.

- Account Architecture

- Recommend bank account structure (income collection, automation paths, and recommended platforms).

- Add a one-line purpose statement for each account to align with my values.

- Debt Elimination Plan

- Organize debts from highest to lowest interest rate.

- Create a monthly payment strategy using the Fire Extinguisher method.

- Calculate timeline to complete debt freedom.

- Emergency & Security Planning

- Set a 6-month emergency fund target.

- Track current status and monthly contributions from surplus.

- Create phases (mini emergency → full MOJO → long-term stability).

- Automation Plan

- Build an automated transfer map showing where each dollar goes after payday.

- Recommend tools (banks, apps, Zapier-style automations) for seamless flow.

- Surplus Allocation & Investments

- Recommend a path to use overflow income for wealth building (long-term investments, compounding savings, diversified assets).

- Offer guidance for beginners: start with $10, then $100/week.

- Review Rituals

- Create a weekly, monthly, quarterly, and annual review system (timeframes, checklists, and reflection questions).

- Mindset & Freedom Vision

- Offer 5 reflection prompts to ensure my money system supports my dream lifestyle—not just more work.

- Help me define what “enough” looks like in time, income, and energy.

- Final Output

- Give me a table that outlines my monthly allocations, timeline to debt freedom, emergency fund milestones, and investment targets in one place.

- Include inspiration: “Money is simply energy. Abundance = Value x Leverage.”

Help me align my financial system with this truth."**

✅ What You’ll Get:

- A clear, personalized 12-month money plan

- Systems to support debt freedom, peace of mind, and overflow income

- A vision-aligned framework that connects money with meaning

- Financial habits that build long-term independence—not just short-term success

Step-by-Step Financial System Setup

- Calculate Your Essential Numbers

- A simple table to determine your key financial figures

- Formulas for each bucket allocation based on your income

- Account Setup Guide

- Spaces to write down your specific bank choices

- Clear purpose statements for each account

- Automation instructions for each money flow

- Debt Elimination Plan

- Structured approach to list and prioritize debts

- Strategy for using the Fire Extinguisher bucket effectively

- Security Roadmap

- Four-phase approach from foundation to wealth building

- Checklist format for tracking progress

- Review Schedule

- Weekly, monthly, quarterly and annual review frameworks

- Time estimates for each review level

- Progress Tracking

- Emergency fund progress calculation

- Debt elimination tracking

- Investment growth monitoring

STEP 1: CALCULATE YOUR ESSENTIAL NUMBERS

| Category | Your Numbers |

|---|---|

| Monthly Take-Home Income | $__________ |

| Essential Monthly Expenses | $__________ |

| 6-Month Emergency Fund Target | $__________ (Essential Expenses × 6) |

| 60% of Income (BLOW Bucket) | $__________ |

| 20% of Income (Fire Extinguisher) | $__________ |

| 10% of Income (Smile/Adventures) | $__________ |

| 10% of Income (MOJO/Emergency) | $__________ |

STEP 2: SET UP YOUR ACCOUNTS

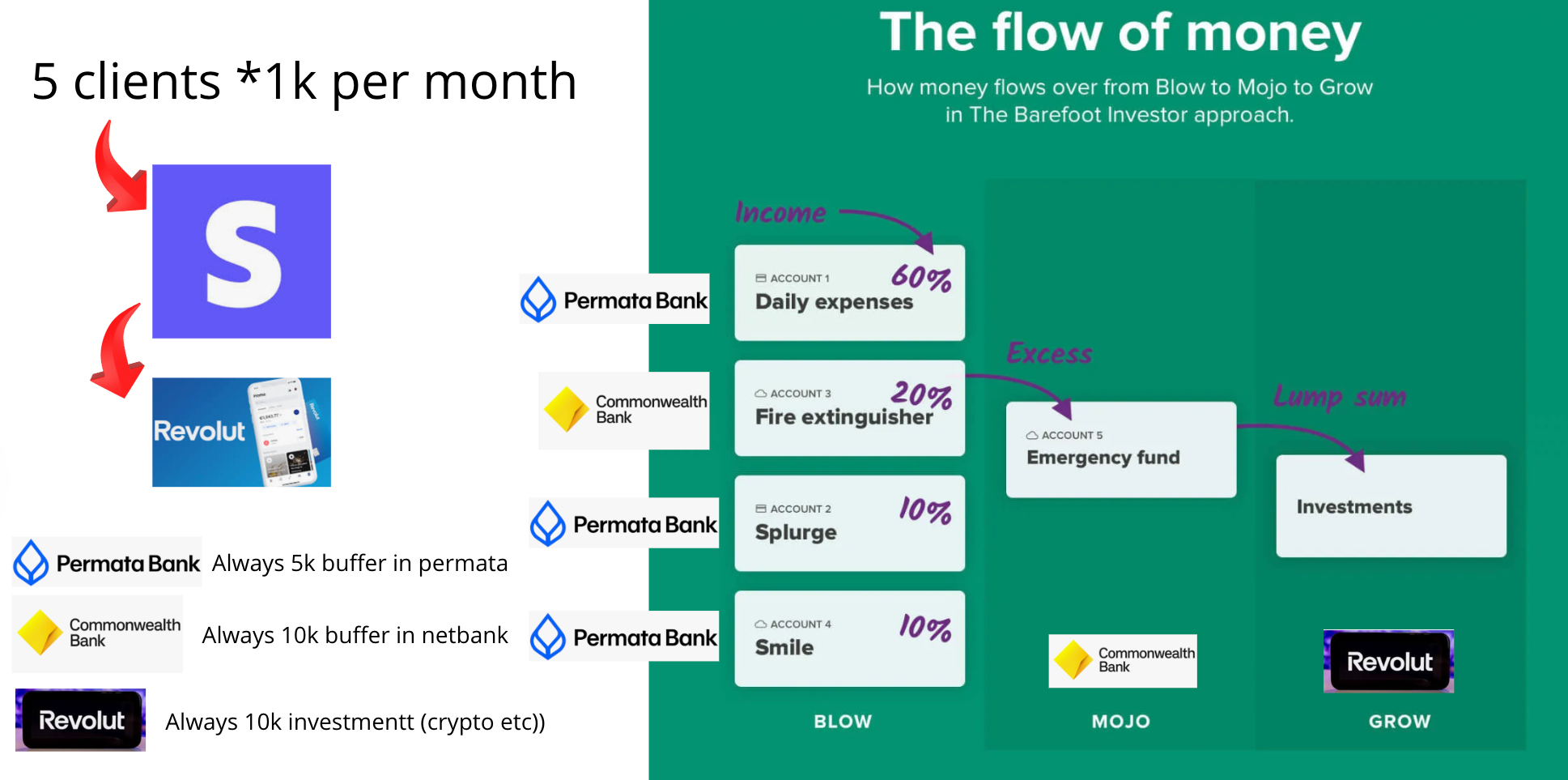

START: Income Collection Account

- Bank: ____________________

- Account Type: _____________

- Purpose: Receives all income before distribution

Example (Digital Nomad, Set up with same bank

- Income Collection: Revolut

- Blow Account (living & Lifestyle): Permata Personal Account

- Mojo Account (Emergency, savings): Commonwealth Bank

- Grow AccountRevolut or investment accounts

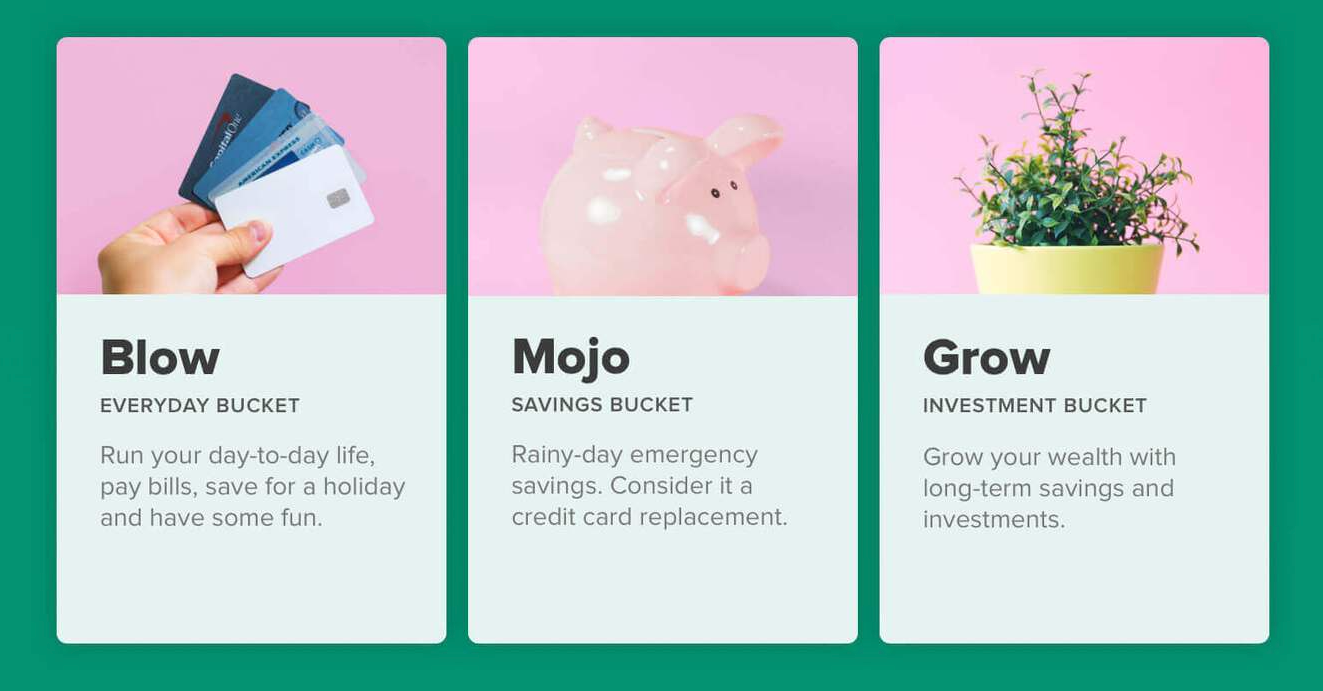

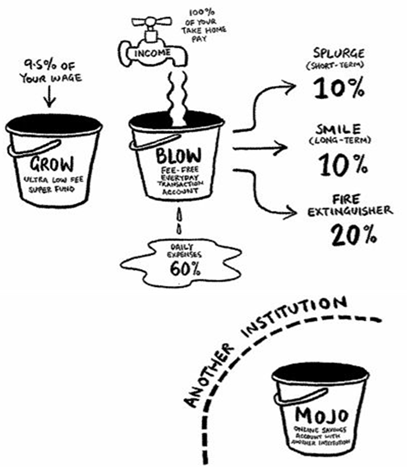

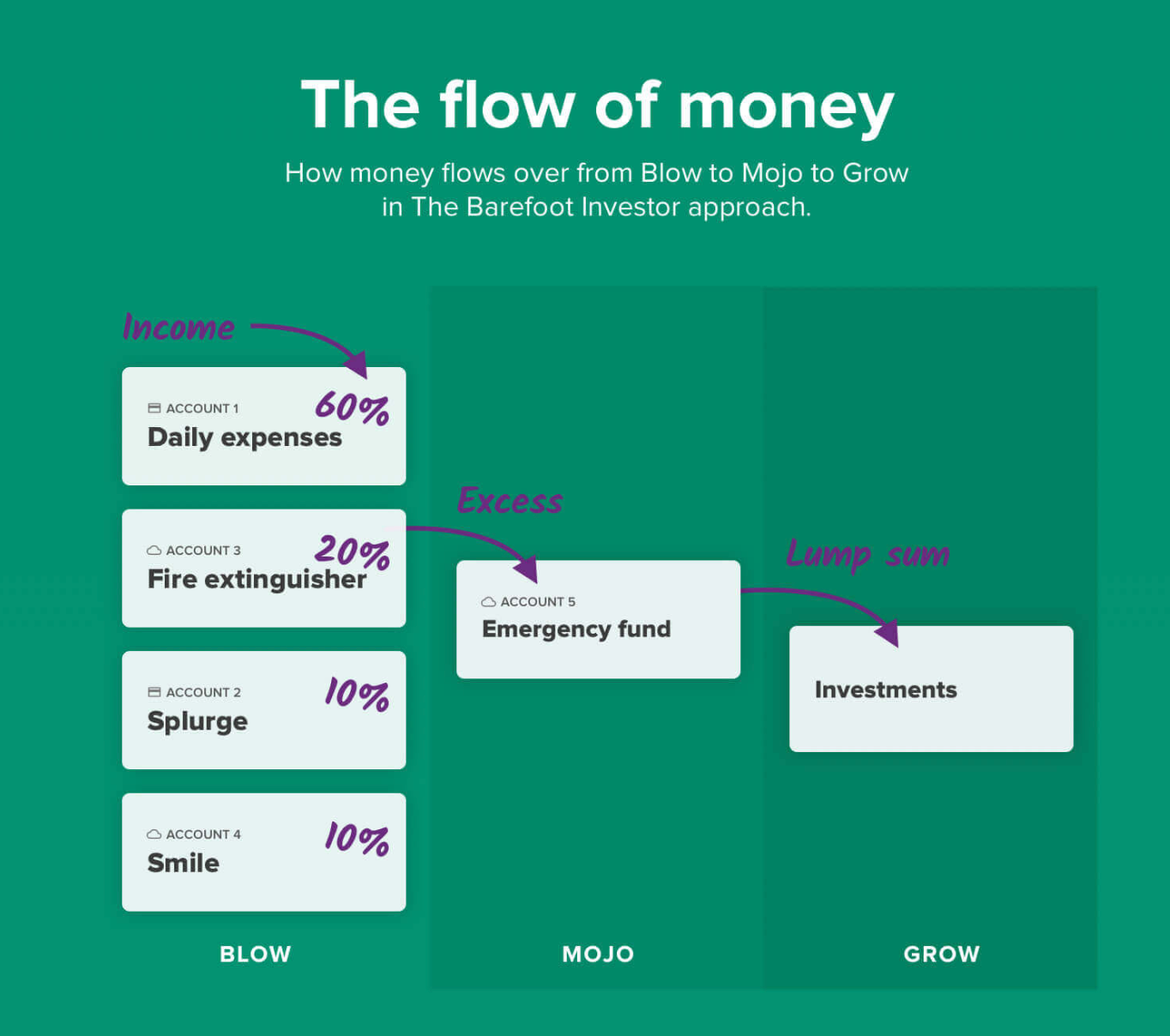

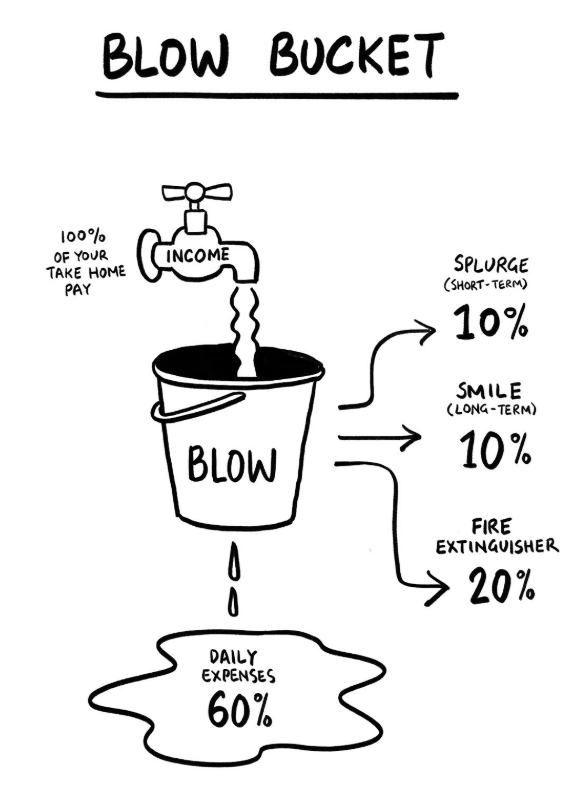

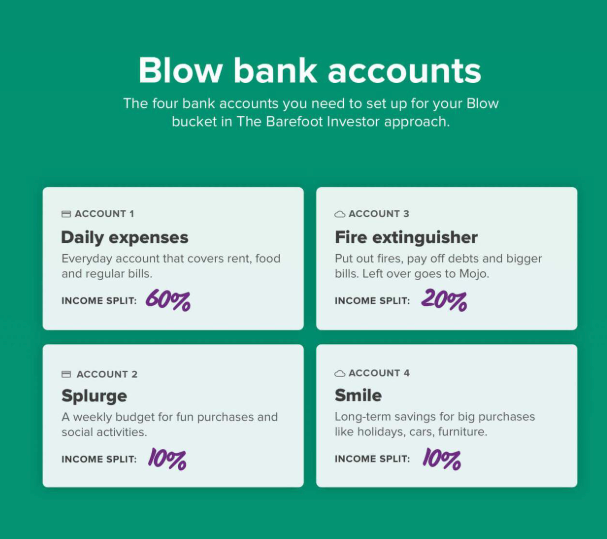

BLOW BUCKET (60% of 100% Income)

1. Daily Expenses (60%)

- Bank: ____________________

- Account Type: Transaction account with debit card

- Monthly Allocation: $__________ (60% of income)

- Purpose: Rent/mortgage, groceries, utilities, regular bills

- Automation: Set up automatic transfer on payday

2. Splurge (10%)

- Bank: ____________________

- Account Type: Transaction account with debit card

- Monthly Allocation: $__________ (10% of income)

- Purpose: Fun money, entertainment, guilt-free spending

- Automation: Set up automatic transfer on payday

3. Smile/Adventures (10%)

- Bank: ____________________

- Account Type: Online savings account

- Monthly Allocation: $__________ (10% of income)

- Purpose: Vacations, experiences, larger purchases

- Automation: Set up automatic transfer on payday

4. Fire Extinguisher (20%)

- Bank: ____________________

- Account Type: Online savings account

- Monthly Allocation: $__________ (20% of income)

- Purpose: Debt reduction, unexpected expenses

- Automation: Set up automatic transfer on payday

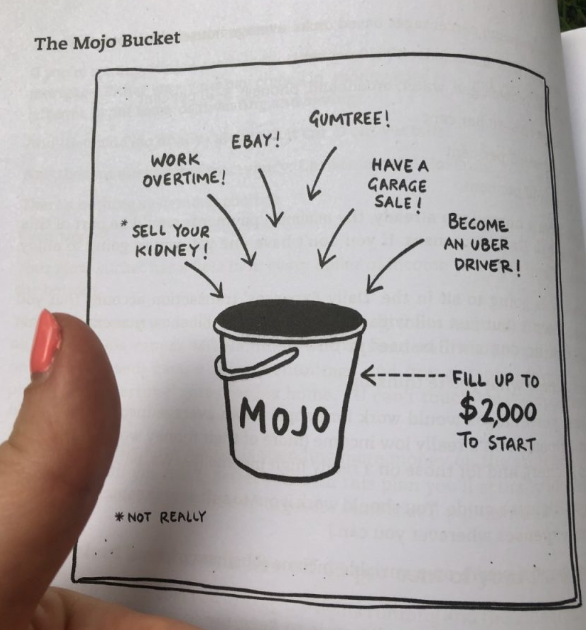

MOJO BUCKET (20% of 100% Income)

5. MOJO Emergency Fund

*How much is needed to give you a 6 month survival buffer?

eg. 4k a month by 6 months, 24k in emergency fund, for 6 months breathing space, no matter what happens in life

- Bank: ____________________ (different from main bank)

- Account Type: High-yield savings account

- Initial Target: $2,000, then grow ;) side hustles, extra income

- Full Target: $__________ (6 months of essential expenses)

- Funding: Receives overflow from Fire Extinguisher once debts are paid

- Purpose: True emergency fund, financial security

6. Long-Term Savings

*Set a number, link to a meaningful goal (eg. 50k for deposit on house, start up new business, get a mentor, travel, self development, adventure, bucket list trips)

- Bank/Institution: ____________________

- Account Type: High-yield savings or low-risk investment

- Funding: Receives overflow from MOJO once emergency fund is complete

- Purpose: Medium-term goals (house deposit, education, etc.)

GROW (20% of 100% Income)

*Use excess money to make you more money. Learn about compound interest, force multipliers, metcalf's law, dollar cost averaging on future trends, stocks, cryptocurrencies, or material assetts that appreciate like gold, silver etc. Start with $10 a week, then $100 a week. Create a 5-10 year plan. Don't touch this. Build the habit, automate it and forget about it. If you need support with a strategy, find people in your network who already have a working one. read rich dad, poor dad, listen to people in abundance mindset, not scarcity mindset. Model success.

7. Investments

- Institution: ____________________

- Account Type: Retirement accounts, brokerage account

- Funding: Receives additional funds as savings goals are met

- Purpose: Long-term wealth building

STEP 3: DEBT ELIMINATION PLAN

List your debts from highest to lowest interest rate:

| Debt | Total Amount | Interest Rate | Minimum Payment | Extra Payment |

|---|---|---|---|---|

| 1. | $__________ | ____% | $__________ | $__________ |

| 2. | $__________ | ____% | $__________ | $__________ |

| 3. | $__________ | ____% | $__________ | $__________ |

| 4. | $__________ | ____% | $__________ | $__________ |

Fire Extinguisher Allocation:

- Make minimum payments on all debts

- Put remaining Fire Extinguisher funds toward highest interest debt

- Once highest interest debt is eliminated, move to next highest

- When all debts are paid, redirect Fire Extinguisher to MOJO

STEP 4: AUTOMATION SETUP

| Account | Transfer Date | Amount | Source Account |

|---|---|---|---|

| Daily Expenses | __________ | $__________ | Collection Account |

| Splurge | __________ | $__________ | Collection Account |

| Fire Extinguisher | __________ | $__________ | Collection Account |

| Smile/Adventures | __________ | $__________ | Collection Account |

| MOJO | __________ | Overflow | Fire Extinguisher |

| Savings | __________ | Overflow | MOJO |

| Investments | __________ | Scheduled | As appropriate |

STEP 5: FINANCIAL SECURITY ROADMAP

Phase 1: Foundation (1-3 months)

- [ ] Set up all accounts

- [ ] Establish $2,000 initial emergency fund

- [ ] Create automation system

- [ ] Begin debt elimination plan

Phase 2: Debt Freedom (timeline depends on debt load)

- [ ] Focus Fire Extinguisher on highest interest debt

- [ ] Maintain minimum payments on all other debts

- [ ] Celebrate each debt eliminated

- [ ] Continue until all high-interest debt is gone

Phase 3: Security Building (3-12 months)

- [ ] Build MOJO to full 6-month emergency fund

- [ ] Maintain other bucket contributions

- [ ] Review and adjust percentages if needed

- [ ] Create or update will and insurance

Phase 4: Wealth Building (ongoing)

- [ ] Begin funding long-term savings goals

- [ ] Maximize retirement contributions

- [ ] Explore additional investment opportunities

- [ ] Review system quarterly and adjust as needed

STEP 6: REGULAR REVIEW SCHEDULE

- Weekly (15 minutes): Quick check of account balances and upcoming bills

- Monthly (1 hour): Full budget review, track goals, make adjustments

- Quarterly (2 hours): Deep dive into investments, bigger picture planning

- Annually (3 hours): Complete financial health check, tax planning, goal setting

STEP 7: FINANCIAL FREEDOM TRACKING

Emergency Fund Progress

- Starting Amount: $__________

- Current Amount: $__________

- Target Amount: $__________

- Percentage Complete: _____%

Debt Elimination Progress

- Starting Total Debt: $__________

- Current Total Debt: $__________

- Debt Reduction: $__________

- Percentage Eliminated: _____%

Investment Growth

- Starting Investment Balance: $__________

- Current Investment Balance: $__________

- Growth: $__________

- Annual Return: _____%

LIFESTYLE DESIGN QUESTIONS

As your financial security grows, consider these questions:

How can I design my work to align better with my ideal lifestyle?

What three experiences would bring me the most joy in the next five years?

How much monthly income would provide me with complete freedom?

What skills or experiences would I pursue if money wasn't a concern?

If my basic needs were met forever, how would I spend my time?

ADJUSTING YOUR SYSTEM

This template provides a starting point, but your financial system should evolve with your life. Consider these adjustments:

Income Changes

- If income increases: Maintain percentages but increase actual amounts

- If income decreases: Prioritize essential expenses and emergency fund

Life Changes

- Relationship: Consider combining certain aspects while maintaining individual accounts

- Children: Increase emergency fund target, add education savings

- Career Change: Temporarily increase emergency fund percentage

- Retirement: Shift focus from accumulation to distribution strategy

MONEY MINDSET PRACTICES

Your financial system is only as strong as your financial mindset. Incorporate these practices:

- Gratitude: Weekly reflection on what you already have

- Abundance: Focus on opportunities rather than limitations

- Patience: Celebrate small wins on your financial journey

- Learning: Continuous financial education through books/podcasts

- Community: Connect with others on similar financial journeys

FINAL REMINDER

Financial freedom isn't just about the numbers. It's about creating a life where money serves your deeper goals and values. This system is designed to give you both security and sovereignty - the foundation that allows you to pursue what truly matters to you.

Review this template every 6-12 months to ensure it still aligns with your evolving life goals and circumstances.

This template is for informational purposes only and does not constitute financial advice. Consider consulting a financial professional for advice specific to your situation.